Hello! This is KOWORK, a pltform for foreign job seekers in Korea ✨

Tax settlement can be an overwhelming process, especially when you are a foreigner in Korea with limited understanding of language and local processes. If you’re working in Korea as an employee, this guide will help you understand exactly how tax settlement or 연말정산 works.

📌 What is 연말정산

You have already paid estimated tax all year - 연말정산 checks if you paid too much or too little.

- 연말정산 is a settlement, not a new tax

- Done once a year

- Your company handles most of the process

- Data from Hometax + submission of documents to your company - That's It

🇰🇷 How the 연말정산 Process Works

1️⃣ Am I subject to 연말정산?

You are eligible for 연말정산 if:

- You worked in Korea as a salary employee (근로소득자)

- You paid monthly income tax from your salary

👉 If yes, 연말정산 applies to you.

⚠️ Freelancers or self-employed individuals do not do 연말정산. They must file 종합소득세 (Comprehensive Income Tax) in May instead.

👨👩👧 Who can you claim? (Deductions Overview)

✅ Basic Deduction (기본공제)

- Self (본인): Always eligible

- Spouse:

- Annual income ≤ 1 million KRW

- (≤ 5 million KRW if wage income only)

- Dependents (income limit applies to all):

- Parents: 60+ (born on or before 1965.12.31)

- Children: 20 or younger (born on or after 2005.01.01)

- Siblings: 60+ or 20 or younger

- Disabled dependents:

- No age limit

➕ Additional Deductions (추가공제)

- Disabled persons

- Seniors aged 70+

- Single parents

2️⃣ Information from your Company (January–February)

Around January to February, your company’s HR team will:

- Send out 연말정산 instructions

- Ask you to:

- Confirm personal details (family, dependents)

- Submit tax-related documents

👉 For most employees, 연말정산 is done entirely through the company.

3️⃣ Check your Data on 홈택스 Website (Hometax)

The National Tax Service (NTS) provides a “Simplified Service” that automatically collects most of your spending data.

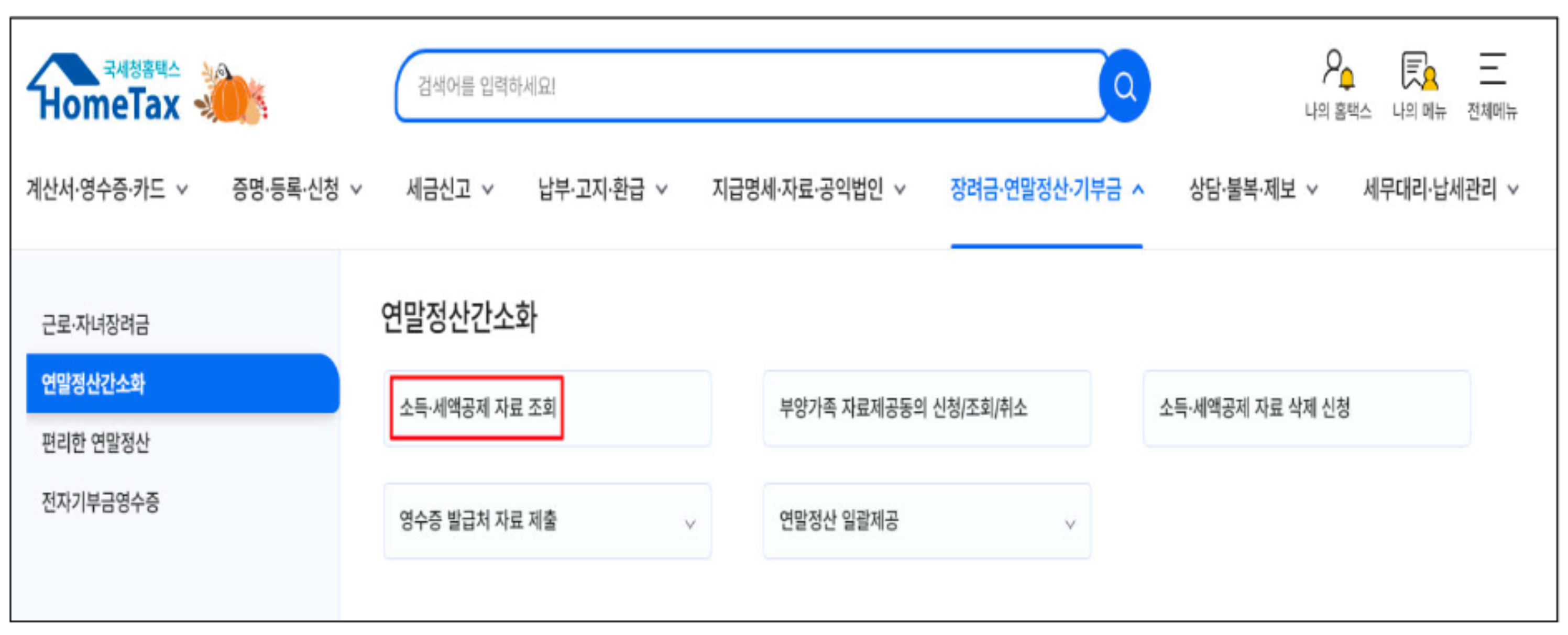

How to access:

- Go to 국세청 홈택스 (www.hometax.go.kr)

- Log in using simple authentication (Kakao, PASS, etc.)

- Navigate to: 연말정산간소화 → 소득·세액공제 자료 조회

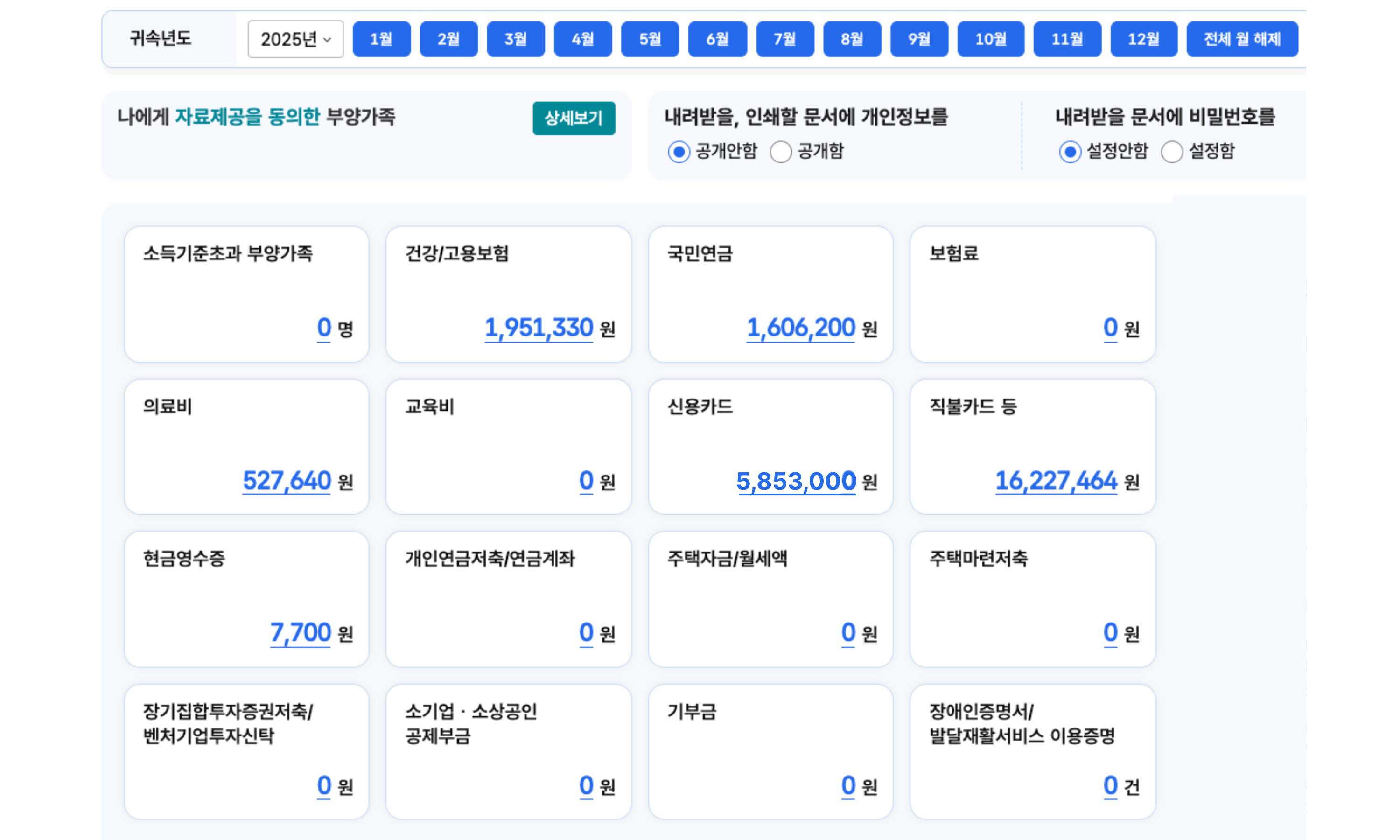

What you can see:

- 🏥 Medical expenses

- 💊 Insurance premiums

- 🎓 Education fees

- 💳 Credit & debit card usage

You can then use “Download All at Once (한번에 내려받기)” to save everything as a PDF or digital file.

👉 You do not need to upload receipts one by one - most data is already collected for you.

4️⃣ Collect Additional Documents & Submit to your Company

Some deductions are not automatically captured and require manual proof.

Common examples:

- Housing

- Monthly rent (월세) payment proofs

- Lease contract

- Housing loan interest certificates

- Medical / Education

- Eyeglasses or contact lens receipts

- Preschool academy fees

- Disability certificates (if applicable)

- Family

- Resident Registration (주민등록표등본)

- Family Relationship Certificate (가족관계증명서), especially if details have changed or are not reflected

Submit these together with the Income & Tax Deduction Report (소득·세액공제신고서) to your HR team by their internal deadline.

💡 Dual-income couple tip (for a future post or deeper guide):

If both spouses work, it’s usually better for the higher-income spouse to claim dependents.

However, for medical expenses and credit card deductions (which have minimum usage thresholds), the lower-income spouse may sometimes benefit more.

5️⃣ Get Refund or Pay Extra Tax?

Your employer will calculate your final tax based on:

- Total annual income

- Taxes already withheld

- Approved deductions

Possible outcomes:

- 💰 Tax refund → If you are eligible for a refund, it will be added to your salary

- 💸 Additional tax → If the 연말정산 process reveals that you are eligible to pay additional tax, it will be deducted from your salary

👉 This is usually reflected in your February or March paycheck.

⚠️ Things to be Careful About

Incorrect claims can lead to penalties or clawbacks later. Avoid these common mistakes:

- ❌ Claiming a dependent whose income exceeds 1 million KRW

(or 5 million KRW if wage-only) - ❌ Double-claiming the same child or parent

- ❌ Claiming a spouse after divorce

- ❌ Claiming deductions for a family member who passed away before the tax year started

SPECIAL CASE

✅ You joined a new company before year-end (still employed on Dec 31)

👉 Most common case

🔹 Who does your 연말정산?

- Your current (last) employer does it for you

🔹 What you must do

- Get “근로소득 원천징수영수증” from your previous company

- This shows salary + tax already withheld

- Submit it to your current employer

- Log into Hometax → 연말정산간소화

- Claim deductions for the entire year (not just current job)

🔹 Important Points

- Income from both companies is combined

- Taxes already paid at the previous company are credited

- Deductions apply only to expenses during your actual employment period

- If you forget to submit the previous company’s certificate → ❌ incorrect settlement

Share this guide with all your foreigner friends and colleagues in Korea and let's make their lives easier ✨